Do Better Deals

Invetics makes the venture capital financing process efficient, accessible, and reliable. Successful private financings depend on the strategic alignment and common understanding of companies, investors, and their lawyers. The Invetics platform empowers dealmakers by creating a unified environment where the economic and legal aspects of a transaction are perfectly synchronized. This integration unlocks unprecedented speed, accuracy, and insight needed to negotiate, structure, and close better deals.

Learn MorePrecision for the Private Market Landscape

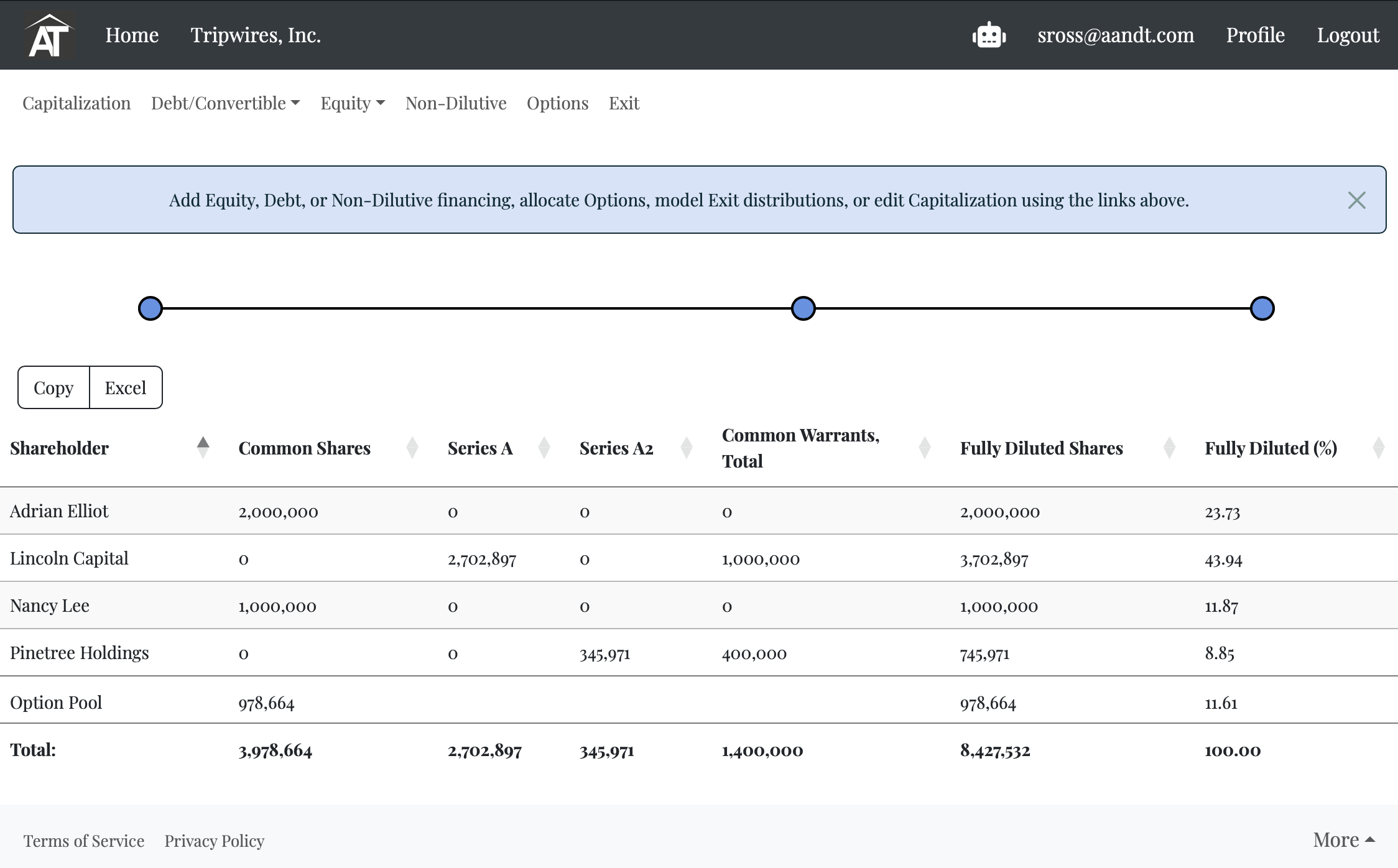

From a founding capitalization, add multiple rounds of equity, debt, and convertible financing. Enter key terms including premoney valuation, investment amounts, debt conversion, tranching, anti-dilution provisions, participation, liquidation preferences, warrant coverage, and various other share characteristics. The platform will calculate interest, dividends, option pools, share prices, share allocations, and share conversion ratios based on those inputs.

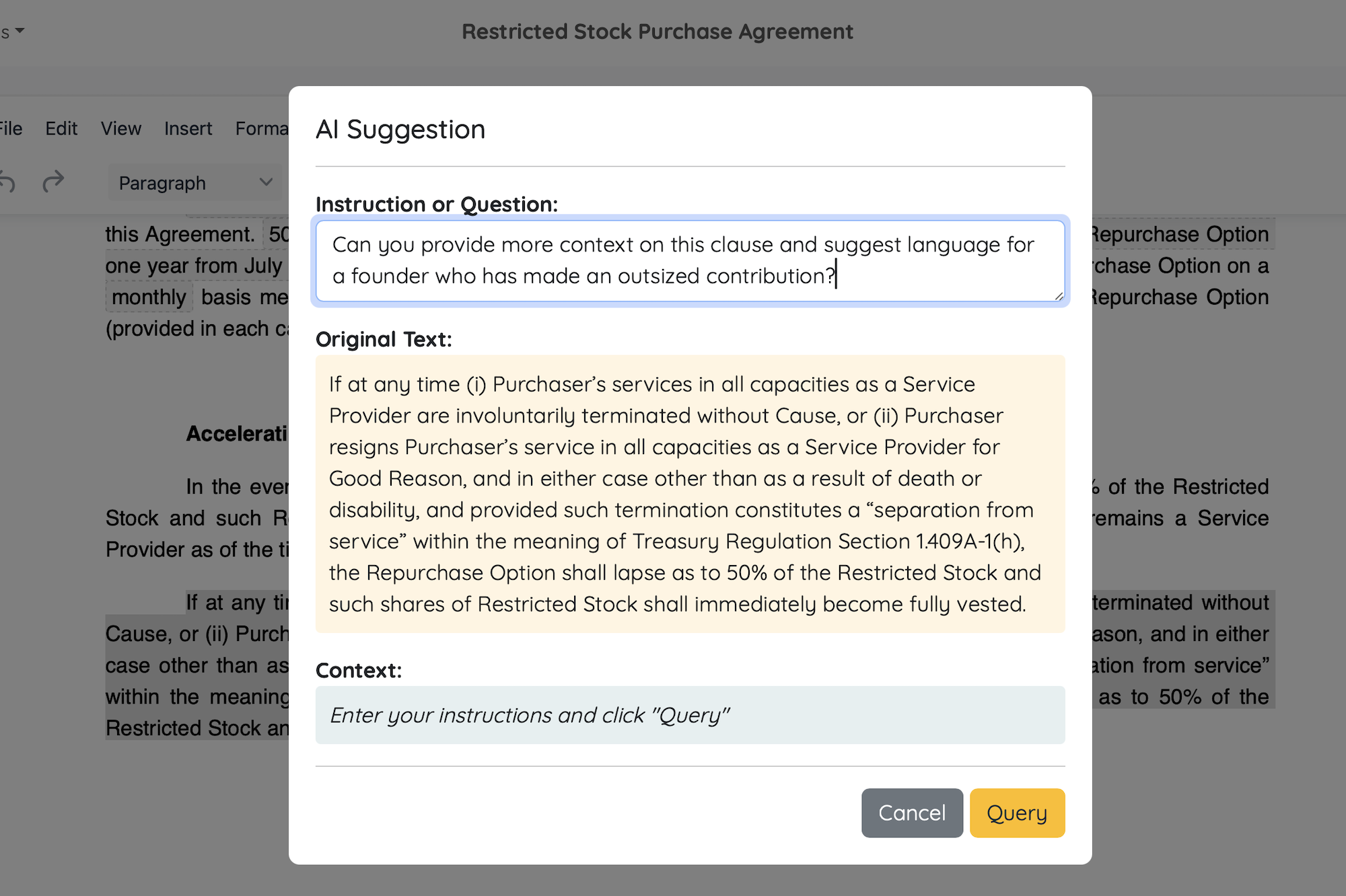

Instantly generate a full suite of documents for any transaction based on your preferred starting point. Review with your deal team and get AI-generated enhancements and entire documents informed by the company’s complete capitalization history and other transactions completed by the firm or fund. Export revised documents, tailored for every stakeholder, for final review prior to deal closing.

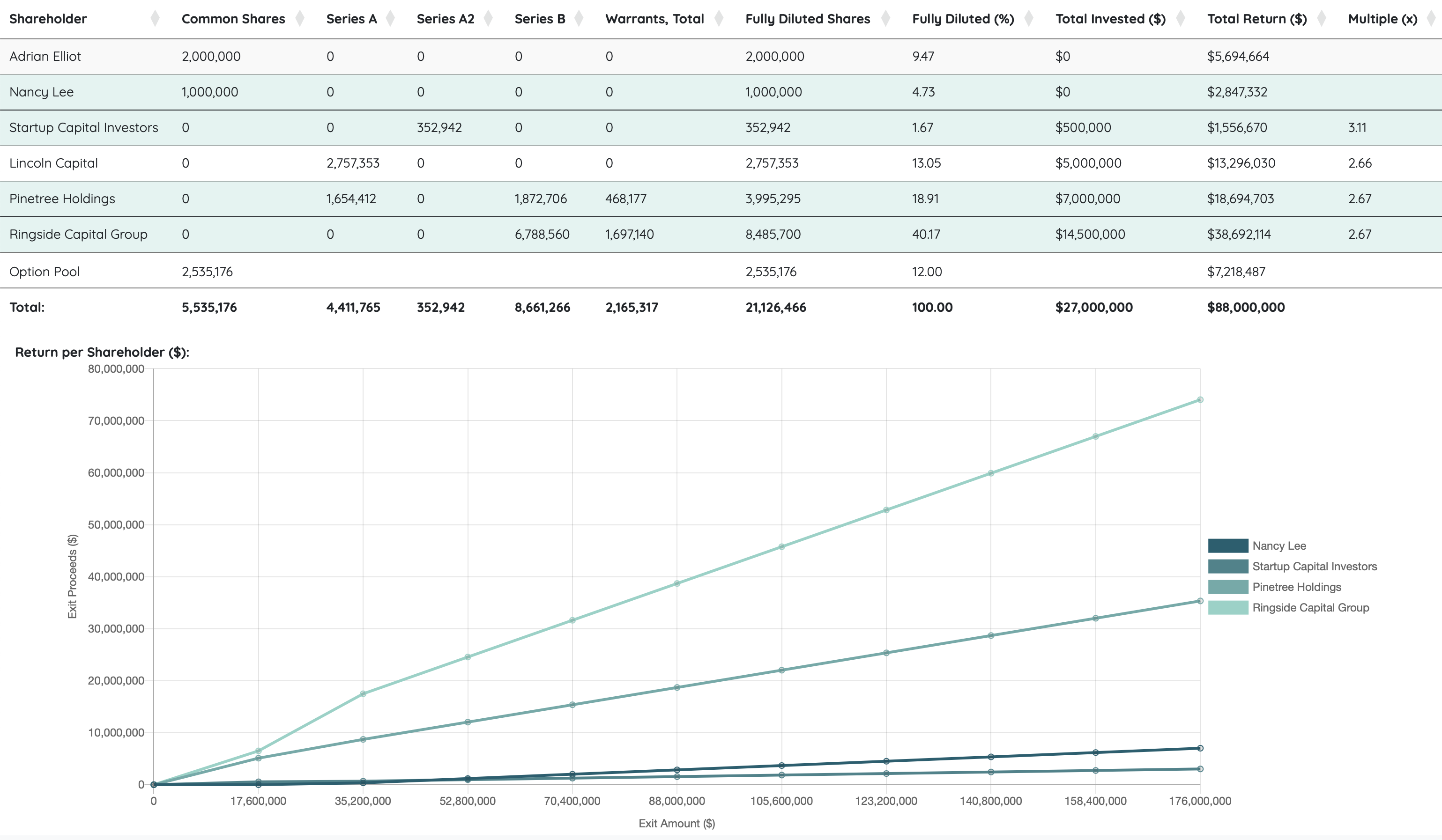

Visualize returns per share class and composite returns per shareholder to understand the dilutive and economic implications of various financial instruments. Formulate financing strategies that align the long term economic interests of founders, employees, and investors.

Customize the Invetics platform for full integration into your existing systems and workflows. Our toolkit allows you to enhance internal efficiencies, standardize deal mechanics across financings, and compare terms against internally derived benchmarks. Additionally, the platform can be used to boost client engagement and drive business development efforts.